The countdown to April 15 is on, and for those who are expecting a tax return the ways to spend the extra cash are near limitless. So why not invest the cash infusion into something useful? Why not use it to reclaim your vision?

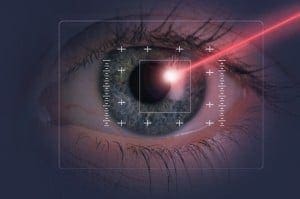

LASIK eye surgery will make a huge impact on your life and the gift of sight keeps on giving for years to come.

A recent Capital One survey found that most Americans (80 percent) expect to get a refund and more than half of those (52 percent) plan to spend the majority of their refund on something they really want. So why not use it for better eyesight?

Last year, the average tax refund was roughly $2,700, according to the IRS. So far, the average federal tax refund this year will be even higher at about $3,116, up 4.2 percent compared to 2013, according to the latest IRS statistics. Depending on what type of procedure your eyes need, this could pay, or at least make a huge dent into your LASIK bill.

While the IRS processes your refund, you can use this time to have your LASIK eye surgery consultation. Call Liberty Laser Eye Center today at (571) 234-5678 to get it on the books. This eye exam is where you learn if you’re a laser vision correction candidate. If you meet the LASIK eye surgery requirements, you can schedule your procedure.

Not expecting a huge refund? Another option is to put the tax refund in a health savings account, or HAS, and save up until you have the full amount saved for your specific LASIK procedure. As more people enroll into health insurance plans with high deductibles, they become eligible to open and contribute to these accounts, which allow pretax contributions. Contributions grow tax deferred, and the withdrawals are used to pay for qualifying medical expenses tax free. The 2014 contributions limit for HSAs is $3,300 for individuals and $6.550 for families (folks age 55 and older can contribute an additional $1,000.)

In turn, the tax refund that you are investing into your eyesight this year may help you save money on your taxes next year. Medical services, such as LASIK eye surgery, dental work, a prosthetic leg, or trips to the chiropractor, can all be deducted from your taxes. Please check with your accountant or tax professional about this.

Using your refund to invest in your body and your health is priceless and can have a major impact on your life. You won’t have any regrets once you see the return on your investment.

To learn more about Lasik eye surgery, click here.